Gavias Blockbuider Title Services

Technology solutions designed for Settlement Service Providers

eSignatures and compliant document workflow:

Advances in technology designed to service the closing process are here. Your “wait and see” decision may become a “watch and see” situation as your competitors harness the eClosing advantage.

SEND

SIGN

ACCESS

STORE

MANAGE

More and more borrowers want the convenience of eSigning their loan documents

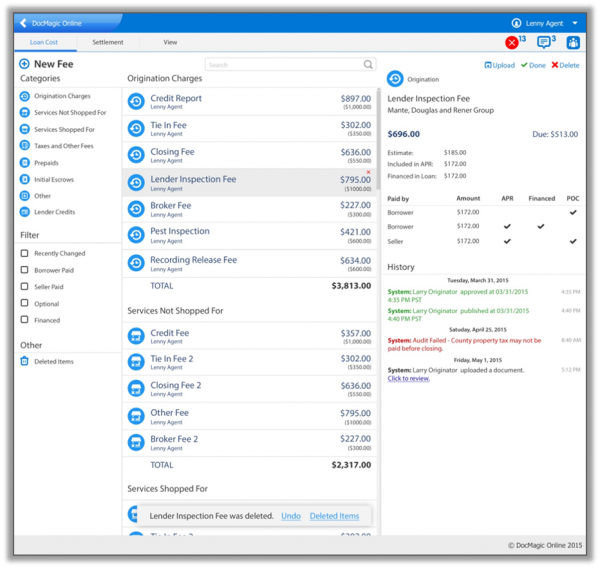

•Share, edit, validate, audit, and track documents, data, and fees prior to closing

•Secure and efficient generation and delivery of system-to-system, GSE-compliant UCD files

•We include both borrower and seller data (if available) in the UCD file format

•System generates UCD XML files with embedded PDF of the Closing Disclosure

•Continuous compliance affecting tolerance levels, calculation reconciliation, RESPA, and TRID issues

•Backed by our Premium Compliance Guarantee

Digital Mortgage Technology:

Introducing a 100% paperless workflow that seamlessly integrates every component of the closing process.

- Improved data and document integrity

- An efficient and transparent closing process

- Loans close faster (with fewer errors and omissions)

- eSign and eNotarize documents from anywhere

eNotary Technology:

Streamline your entire closing process — paper is eliminated, costs are reduced, and compliance is ensured.

Eliminate the hard stop in the closing process and allow borrowers to effortlessly eSign mortgage documents.

The Settlement Agent Portal to a Digitized Closing:

The Settlement Agent Portal gives you new levels of access to the Closing event — and the power to enhance the overall borrower’s experience.

- Closing documents stay 100% paperless from eDisclosure to eClosing

- Review closing document Packages prior to closing

- The portal gives settlement service providers the ability to add title documents to the closing package

- Add postfill fields & control the eSignature process right from the portal

- Borrowers can easily eSign mortgage documents — even those that require the presence of a notary

Compliance is the core

We can help you to transform your processes through the implementation of automated compliance — a core compononent inside all of our mortgage technology solutions.